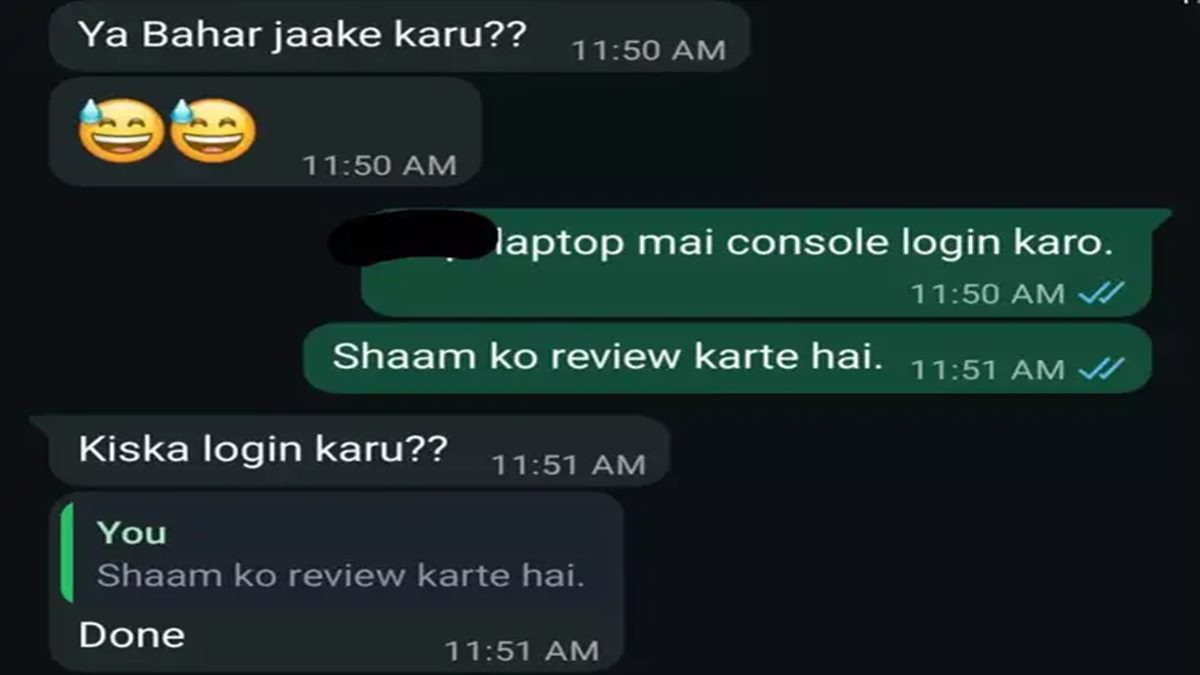

A serious flaw in the Income Tax Return (ITR) utility for FY 2024–25 could disrupt House Rent Allowance (HRA) claims for lakhs of salaried taxpayers, warned Chartered Accountant Himank Singla. The issue stems from the ITR portal prompting users to enter their “Place of Work” instead of “Place of Residence” for computing HRA exemption under Section 10(13A).

“This is a critical error,” said Singla. “The Income Tax Act mandates that the HRA exemption is determined by the taxpayer’s residential city, not where they work. If you live in a metro city, you’re eligible for 50% your salary as an exemption; for non-metro cities, it’s 40%.”

Due to this glitch, individuals who live in metro cities but work elsewhere—or vice versa—may either overclaim or underclaim HRA, potentially triggering scrutiny or defective return notices.

“This is a textbook example of how a minor design flaw can lead to major compliance risks,” Singla said. “Until the utility is fixed, taxpayers must override the portal’s suggestion and manually calculate their exemption based on actual residence.”

Singla urged the Income Tax Department to rectify the issue immediately to avoid widespread filing errors, especially as the deadline approaches.

Understanding HRA exemption under Section 10(13A)

HRA is a part of a salaried employee’s income, meant to help cover rental expenses. While fully taxable by default, partial or full exemption can be claimed under Section 10(13A)—but only under the old tax regime. No exemption is allowed if you live in your own house or opt for the new tax regime.

The exempt amount is the least of the following:

Actual HRA received

50% of salary (metro cities) or 40% (non-metros)

Rent paid minus 10% of salary

Here, salary includes basic pay, dearness allowance (if part of retirement benefits), and commission (if based on turnover).

This exemption is widely used by salaried individuals, but several conditions must be met. You must:

Be salaried and receive HRA

Live in rented accommodation

Maintain valid rent receipts and proof of rent payments

If rent exceeds Rs 1 lakh per annum, quoting the landlord’s PAN is mandatory.

Example Calculation

Suppose you live in Delhi, earn Rs 25,000 basic and Rs 2,000 DA, and pay Rs 10,000/month in rent. Over the year, your actual rent is Rs 1.2 lakh. The HRA exemption will be the lowest of:

HRA received (say Rs 1 lakh)

50% of salary: Rs 1.62 lakh

Rent paid minus 10% of salary: Rs 87,600

In this case, only Rs 87,600 is exempt, and the balance HRA is taxable under the old regime. Under the new regime, the entire Rs 1 lakh is taxable.

Documents required to claim HRA exemption

While supporting documents are not filed with your ITR, they must be preserved for employer verification and departmental inquiries. Key documents include:

Rent receipts for the applicable financial year

Rental agreement as proof of tenancy

Form 12BB, which declares your HRA claim to your employer

Bank statement or payment proof showing rent transfers

Salary slip reflecting the HRA component

PAN of landlord, if annual rent exceeds Rs 1 lakh

If the landlord doesn’t have a PAN, a self-declaration is required as per CBDT Circular No. 8/2013 dated 10 October 2013. Failure to provide these may lead to denial of exemption during scrutiny.