Inside one of ANZ’s Docklands office towers in Melbourne is a technology hub that has turned into a laptop graveyard lately. Staff made redundant as part of mass culling of 3500 jobs under new boss Nuno Matos have been making the final trip to the building to drop off company hardware.

The hub is in the newer of the two towers. “The fancy tower with the MacBooks for the cool kids at ANZ Plus,” according to one staff member who requested anonymity to speak freely.

There is no clearer image of the task ahead for Matos than those two towers. ANZ is a disjointed business that he must unify and overhaul to get it performing better. Its retail division operates like three banks: ANZ, the digital ANZ Plus, and Suncorp Bank. Its workforce is also larger than the more profitable rivals Westpac and National Australia Bank.

So Matos, who started in May, is wielding the axe with one of the most dramatic redundancy announcements of recent times. He’s paved the way for rivals to follow, triggering what the Finance Sector Union has described as a “tidal wave of cuts” across the sector, even though the cuts only account for about 3 per cent of the total big four bank workforce.

This past week, NAB announced 410 jobs were being made redundant while 127 were moving to India and Vietnam. Meanwhile, Westpac has revealed 1500 redundancies as chief executive Anthony Miller streamlines the business. Miller faces similar issues to Matos, previously lamenting: “I am running three regional banks.”

“From a finance perspective, banks have been running fairly fat.”

— Matthew Haupt, Wilson Asset Management

Westpac’s Project Unite is designed to bring together the subsidiaries St George, BankSA and Bank of Melbourne into one system.

Smaller lender Bendigo Bank also revealed a restructure in the past week, which the union claimed could affect at least 145 jobs. A Bendigo statement said the priority was “investment in innovation”. Its competitor Bank of Queensland announced 200 redundancies last month.

Back at ANZ, there are few farewells as thousands head for the exits. Many are choosing to go quietly amid what one staff member described as a “tornado of disruption” since former HSBC banker Matos joined. Even those who have served 20 or 30 years with ANZ are considering departing without much fanfare. Some staff have sent their thoughts on the business to the corporate watchdog and prudential regulator on the way out.

ANZ’s job cuts have not been limited to low-profile back-office jobs. Matos is also shaking up the executive ranks. His arrival coincided with the swift departure of Maile Carnegie, the boss of ANZ’s retail division, who was in charge of the botched ANZ Plus rollout. Technology group executive Gerard Florian has also left, and this week, the chief of ANZ’s scandal-ridden markets division Anshul Sidher left to pursue other opportunities. As well, came news this week that Kevin Corbally, ANZ’s long-serving chief risk officer, was moved into another role in the institutional bank.

Like Matos, Miller has also made high-profile changes at Westpac’s leadership. Most recently, Carolyn McCann was added as its new retail banking chief. Miller has also poached executives including Nathan Goonan, who joined as its chief financial officer from NAB, and former Commonwealth Bank banker Paul Fowler, who now leads Westpac’s business and wealth division.

The layoffs and restructuring reflect a broader reckoning across the sector, which has grown bloated since the 2018 banking royal commission. Staff numbers had risen across the sector to deal with compliance issues and failures identified in the commission’s report. When the pandemic hit, and government support packages and flexible working arrangements were introduced, those banking jobs became ones to hold on to in tumultuous times.

In the years following, the banks were among the country’s few big employers, outside the state and federal government public service, still offering staff the opportunity to work several days a week remotely. Attrition rates fell from the mid-teens to under 10 per cent.

CBA has had the biggest workforce of the four major banks, with almost 50,000 staff globally, followed by ANZ at 43,094, NAB at 39,976 and Westpac at 35,969.

“From a finance perspective, banks have been running fairly fat,” says Matthew Haupt, lead portfolio manager at Wilson Asset Management, which owns ANZ shares. “It’s long overdue.”

WAM also invests in other major banks and Haupt predicts the cuts in back office jobs to continue across the sector as the rollout of technology creates more opportunity for savings.

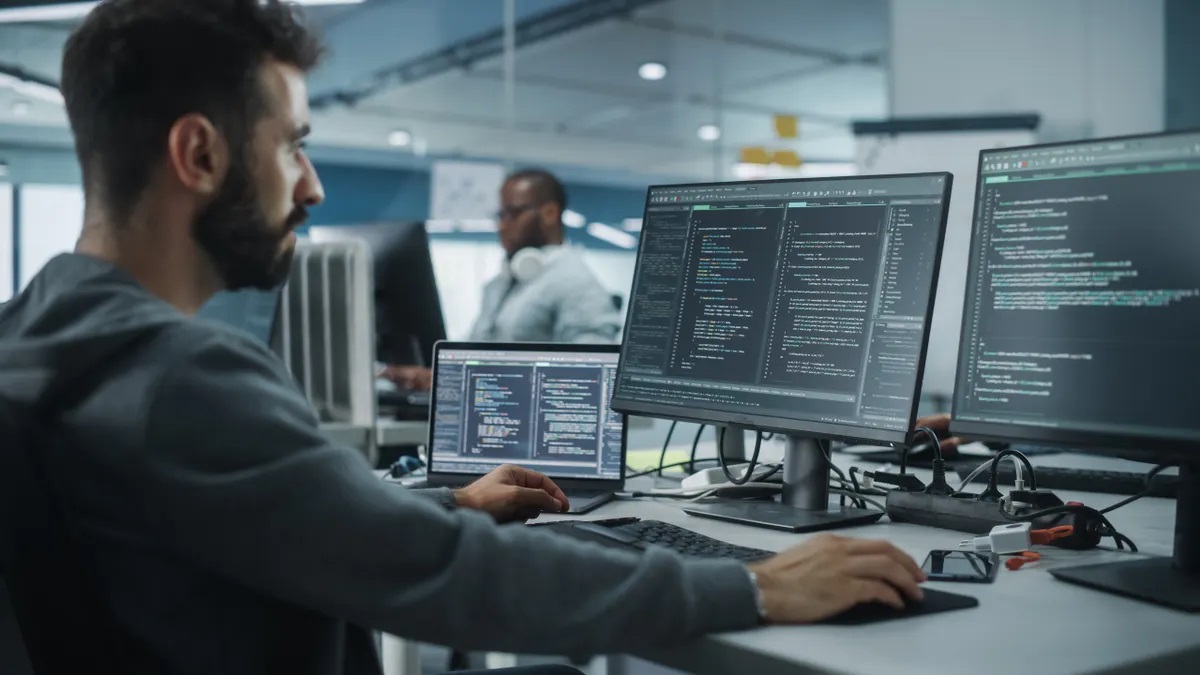

Haupt says ANZ, Westpac and NAB, where the redundancies have been concentrated, have been forced to accelerate their adoption of technology by market leaders Commonwealth Bank and Macquarie.

“Macquarie and CBA are pretty good on their tech, so it’s a lot of catch-up and historical legacy items to deal with now.”

He frames it as a post-royal commission correction. Where previously banks were focused on regulation, now they are course-correcting old, clunky technology and streamlining the workforce to match, and that is reflected in the share prices.

Since late 2021, the shares of the four major banks have outperformed the broader S&P/ASX 200 Index, but only just in the case of ANZ.

The latter has long been considered the laggard of the big four lenders but in the year to date, its fortunes have started to turn, with shares outperforming the S&P/ASX 200 and CBA.

Those who have worked in the banking sector long enough say they haven’t seen staffing cuts as deep as this for decades. In the 1990s, Australian banks closed a third of branches and slashed headcount by 30 per cent.

But after a volatile earnings season where blue-chip stocks such as Woolworths and CSL tanked, Jarden analyst Matthew Wilson says bank chief executives are hamstrung by extreme valuation expectations and a sombre earnings environment. “Real value creation is generally driven by superior revenue,” he says, adding revenue has been down across the banks.

Earnings have also been challenged. A key profitability metric for the big banks is also how much cash they generate for every share on issue and this was down across the board for all of them in their most recent financial full year. CBA and Westpac reported the smallest declines, down 1 per cent and 2 per cent respectively, while NAB and ANZ were down 7 per cent and 9 per cent respectively.

Put another way, ANZ, NAB and Westpac made between $2-$2.30 per share while CBA made significantly more at $5.89.

Taking a longer view, ANZ’s cash earnings per share grew at a compound annual growth rate of 1 per cent in the past three years, whereas CBA grew at 5.8 per cent in the same period, NAB at 4.8 per cent and Westpac at 11.1 per cent.

“[Banks] used to grow at 8 to 10 per cent per annum, they now grow at 1 to 2,” says Jarden’s Wilson.

For most of the bank chief executives, there is the added conundrum of their share prices trading on high multiples. If they want to keep them at that level, they will have to either boost earnings, or cut costs, and the latter is easier.

“No one wants their share price to fall 10 per cent,” says Wilson.

Bank shares normally trade at 10 to 12 times their earnings. Commonwealth Bank is trading at 27 times its earnings, Westpac and NAB at 20 times and ANZ at 13 times.

In July, a KPMG report found 53 per cent of banks globally expected to cut costs at least 10 per cent by the end of the decade. However, one-third of respondents were planning to cut costs by 20 per cent in the same period.

Morgan Stanley analyst Richard Wiles says ANZ’s potential cost savings from laying off staff could boost earnings by 7 to 8 per cent.

“At first glance, we see potential savings of $0.7 billion to $0.8 billion relating to employee and third-party costs,” he says, while acknowledging that the departure of such a large cohort of employees would be a “near-term distraction”.