The now active new Codes on Wages, Industrial Relations, Social Security, and Occupational Safety and Health are likely to change the way benefits are calculated for workers. As per the new rules, employers will have to ensure that at least 50 per cent of the employee’s CTC should make up the base salary.

It is pertinent to mention here that provident fund (PF) and gratuity are calculated on the basis of the basic salary. So, if the basic pay goes up, the PF and gratuity contributions will also go up, from the employees as well as the organisation they are working for.

With the definition of ‘wages’ covering basic pay, dearness allowance and retaining allowance, and with half of the total pay being considered as wages, the calculation of provident fund and gratuity will be affected. The base pay from which deductions are made is going to rise, but with the deductions also rising, net take-home salary can decrease if pay structure is not adjusted, experts reportedly feel.

If the number of allowances that become part of the base pay are increased, then the net salary will decrease due to other PF deductions and other cuts.

However, the employees are likely to end up with a better savings for their retirement.

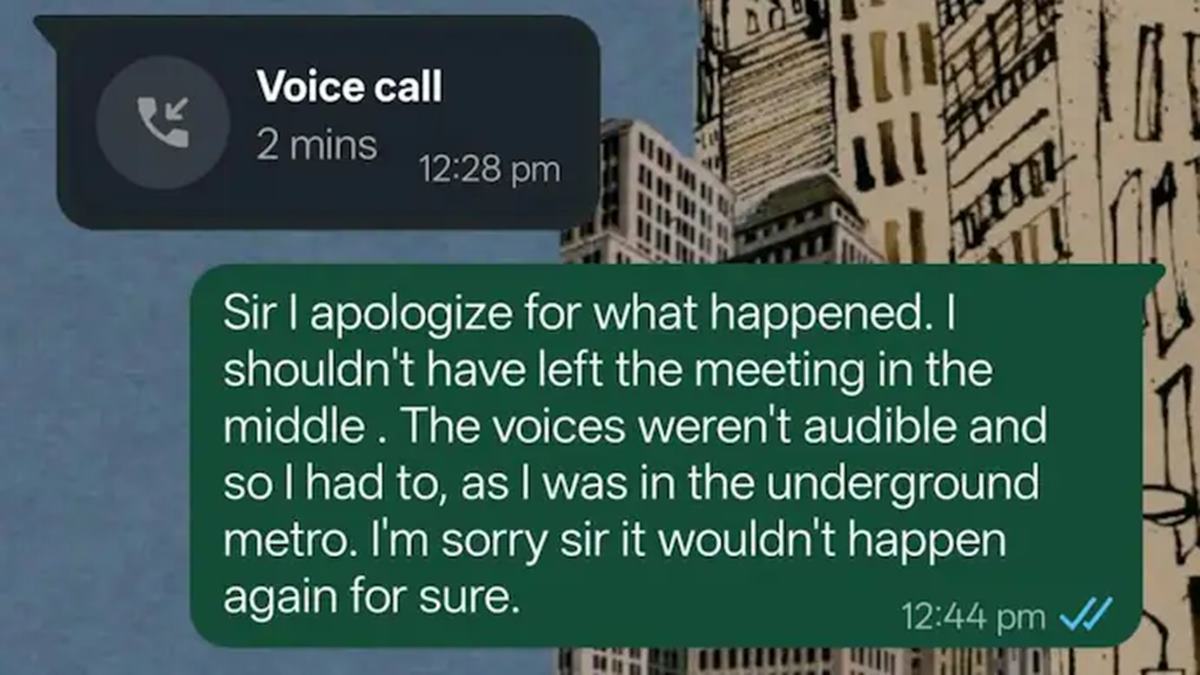

More employees are worried about their employers making retrospective deductions to make up for the times when basic pay was less than 50 per cent of total compensation.