A Bengaluru-based tech professional has gone viral on Reddit after sharing his story of growing from a ₹2.4 LPA job to building a net worth of over ₹1 crore before the age of 30.

In a detailed Reddit post titled “Milestone Check: Started at 2.4 LPA at 23, Achieved 1cr before turning 30,” the anonymous user narrated his journey, which involved no family wealth, no shortcuts, and plenty of lessons.

Humble beginnings and a window seat priority

“I come from a low-income family. My dad earned around ₹7–8K/month, my mom maybe ₹5–7K,” he wrote. Money was always tight, but he ended up in a decent private school with a fee of ₹1,200/month. “Miracles happen,” he said.

Despite being lazy, he scored 89% in both 10th and 12th grades, balancing studies with cricket. After bombing the JEE due to no coaching, he joined a local private engineering college, mainly because the college bus started from his area. “Guaranteed window seat for four years. Priorities, right?”

The family struggled to afford college fees. Loan applications were rejected, but relatives helped.

College to code: Discovering passion

Initially an Electronics and Communications student, he spent most of his college life building electronics projects for fun. Gradually, he shifted focus from electronics to programming.

By the final year, he was among the 35 students selected from over 400 candidates by a known service-based company.

Bengaluru job blues: Surviving on ₹15K/month

In 2018, he started his first job in Bengaluru with a salary of ₹2.4 LPA (₹15K/month).

“I was terrified. How do you survive in a city like Bangalore with that kind of salary?” he recalled. Living in a 3-sharing PG and stretching ₹500 like ₹5,000 helped. He managed to save ₹2,000/month and enjoyed the process.

After 1.5 years, he felt ready to move on.

COVID disappointment and a toilet call breakthrough

In early 2020, he cleared all rounds at a Big 4 firm with an expected salary of ₹6–8 LPA. Then COVID hit, and the company ghosted him.

In April 2021, while in the toilet, he got a callback for a job interview. Expecting ₹6 LPA, he was shocked when the HR said, “We’ll pay you much more than that.”

It was a ₹12 LPA offer. But he had to convince his current employer to release him within 60 days.

Luckily, since he was on the bench, his manager agreed to release him in 15 days. He joined the new healthcare startup in April 2021.

Great Resignation: 13 offers in hand

In 2022, as teammates left during the Great Resignation, he began applying again.

By March 2022, he had 13 job offers. Some great, some “red flags dipped in glitter.” He joined a product-based firm offering ₹32 LPA with stock options. His total compensation grew to ₹45–50 LPA over time.

A simple life with strategic spending

He lives simply, enjoys travel and Zomato, and still uses an Android phone from 2019. Most clothes are office tees and low-cost jeans.

“I’ve never felt the urge to chase luxury,” he wrote. Shoes? ₹250, with ₹1000 soles. “Gotta protect those knees, not the brand image.”

The investment journey: From FDs to SIPs

Between 2018 and 2020, he kept his savings in a salary account. His first investment? A ₹3.5 lakh FD with monthly payouts.

He later discovered personal finance via YouTube (especially Pranjal Kamra). He started SIPs in 2021 with ₹5K each in PPFAS Flexi Cap and ELSS. Despite negative returns early on, he remained invested.

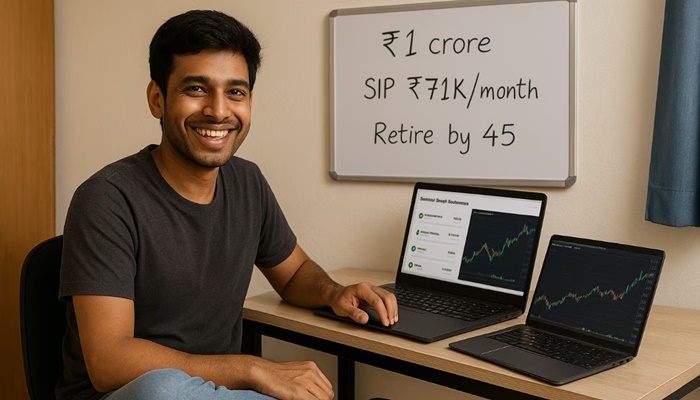

By 2025, he invests ₹71K/month via SIPs. His take-home is ₹1.6L/month. He supports family, pays rent, spends on food and travel.

His original FD was converted to a standard maturity FD, now his emergency fund.

He bought term insurance and health coverage: ₹25L for himself and ₹10L for parents.

Net worth snapshot

He began tracking his net worth in 2023. Here’s how it evolved:

| Asset | 2023 | 2024 | 2025 |

| Mutual Funds | ₹13L | ₹28L | ₹39L |

| Comp Stocks | ₹6.7L | ₹19.6L | ₹43.1L |

| Stocks | ₹0.68L | ₹1.05L | ₹0.9L |

| FD | ₹2.5L | ₹2.5L | ₹2.8L |

| PF | ₹4.7L | ₹6.95L | ₹9.38L |

| PPF | ₹3.18L | ₹4.33L | ₹5.12L |

| Cash | ₹0.8L | ₹0.8L | ₹0.5L |

| Total | ₹31.6L | ₹63.2L | ₹100.8L |

The next goal: Early retirement

He plans another job switch within 1–2 years. The ultimate goal? Retire by 45.

“Hopefully by then, my investments and savings should be enough. After that, I’d like to focus on other things—health, travel, hobbies, maybe even helping others who are where I once was.”

His final words: “You don’t need to have it all figured out. Be frugal where it matters, splurge where it counts, and never underestimate the power of compounding—financial and career-wise.”

“Stay humble. Life has a funny way of keeping you grounded. Like your ₹250 shoes falling apart while your stock portfolio quietly climbs.”