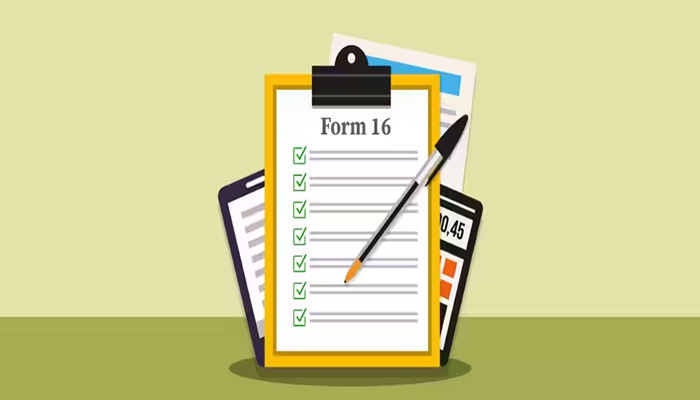

There is great news for the employed people! Now they will not face any difficulty in filing their Income Tax Return (ITR). The digital form will make their work very easy. Form 16 has been issued for filing returns of employed people. It contains information like an employee’s salary income, TDS (tax deduction at source), and deductions. Now employers are going to issue digital Form 16 to their employees. So, if you also do a job, then know about this new facility in detail.

Digital Form 16 is another name for the trust

Digital Form 16 is generated directly from the TRACES portal. This is the electronic form of the traditional Form 16. TRACES is an income tax portal, due to which is very reliable. This means that the data on salary income, TDS, and deductions in the digital Form 16 will be completely accurate and reliable. The data included in the traditional Form 16 had to be matched with Form 26 AS and AIS, but this hassle will end with digital Form 16. So, now you do not have to worry much about the accuracy of the data.

Filing returns has become child’s play

Now, working people will be able to file ITR easily. They have to go to the income tax department’s return filing website. Then, they have to choose the right ITR form for themselves. As soon as the digital Form 16 is uploaded, all the information will automatically come in the ITR form. These will include information like salary, income, TDS, and deductions. Now you will not have to fill in all the details one by one, which will save you a lot of time.

There will be no mistake in the tax calculation as well

Tax calculation will also be done easily with the digital Form 16. This will save a lot of time spent on return filing. Also, the processing of returns will also be faster. Now you do not have to worry about the calculation of tax, the digital form will make this work easy too.

Time will be saved, and the process will be faster

With faster processing of returns, it will not take much time for the refund to arrive. The last date for filing income tax returns is usually July 31. Sometimes this date is also extended if needed. During COVID-19, the deadline for filing returns was extended. Filing returns after this date attracts a penalty and interest. But now the digital form is expected to speed up the process.

There will be no fear of misuse of the digital Form 16

There is no fear of misuse of digital Form 16 as it is password-protected! It is safe because it is password-protected. A standard format is used for its password. It keeps your financial data safe. Another advantage of this is that its use is also beneficial from an environmental point of view. Since the document is digital, there is no need to print it. This reduces the use of paper. So, digital Form 16 is not only convenient for you, but also good for the environment.