In a world flooded with information and shaped by algorithms, trust has become the most valuable—and elusive—currency. Consumers today are more sceptical than ever, questioning not just what they see online but the intentions behind it. For industries like insurance, where the product is a promise and the purchase is deeply personal, trust isn’t just important—it’s everything.

Unlike impulse-buys, insurance is a long-term commitment, a promise of protection against the vagaries of life. Customers today aren’t just buying policies, they’re looking for reassurance, transparency, and human touch. And in this experience-driven economy, one of the most powerful drivers of that trust is often overlooked: the engagement of the people behind the brand.

In insurance- and life insurance largely- employees form the face of the brand. They are the first form of human contact in a category that’s complex and often misunderstood. Their ability to connect, empathize, and communicate clearly can make the difference between a customer walking away uncertain or feeling reassured and confident.

India is on a mission to achieve “Insurance for All” by 2047, a transformative initiative with the goal of ensuring every citizen has access to quality insurance coverage. However, as of last year, India’s penetration has been much lower at 4% than the global average of 6.8%. India ranked 25th in insurance penetration and 27th in insurance density globally in 2022-2023.1 This gap is a call to action.

Employees, when reasonably motivated and engaged- can be the catalysts for change. When well-informed and emotionally invested, they can initiate meaningful conversations and translate the brand into an emotion that resonates with people.

We’re seeing this shift play out in real time through the rise of Employee-Generated Content (EGC). Across social media, employees are stepping into the spotlight—participating in trends, sharing behind-the-scenes glimpses of their work, and creating relatable content. These authentic expressions humanize the brand, making companies more approachable and trustworthy in the eyes of consumers. At FGILI, we have a dedicated women only channel called WiN, which focusses leveraging social media for creating awareness about insurance and our products.

A well-engaged workforce doesn’t just reflect enthusiasm, it reflects alignment. Employees who understand their company’s vision and values, believe in the product, and feel supported in their role, naturally embody the values that customers seek: clarity, consistency, and care. These aren’t just HR ideals—they’re the building blocks of long-term brand credibility.

Across the insurance industry, there’s a growing emphasis on equipping employees with deeper product knowledge and a clearer understanding of the company’s mission. When employees are empowered to ask questions, participate in strategic discussions, and understand the “why” behind decisions, they become more than just messengers. They become trusted advisors who can simplify complex concepts and guide customers toward informed choices.

In a competitive landscape where new players are constantly emerging, unlocking employee potential through training is essential. Well-informed employees are significantly more effective in raising customer awareness and delivering clear, empathetic communication. This directly enhances customer experience and strengthens brand credibility. Simply put, internal clarity breeds external confidence. With this objective, at FGILI, we have structured training interventions tailored for different cohorts of employees focussing on product knowledge, customer interactions and reinforcing our core values and Lifetime Partner Behaviours.

Today, insurers are actively tapping into insights from customer-facing teams. Employees serve as a direct conduit to the consumer pulse. The feedback shared by staff is invaluable in refining product messaging, identifying pain points, and shaping customer education strategies. When organizations actively listen and incorporate these insights, they create sharper communication, more relevant offerings, and ultimately, stronger consumer trust.

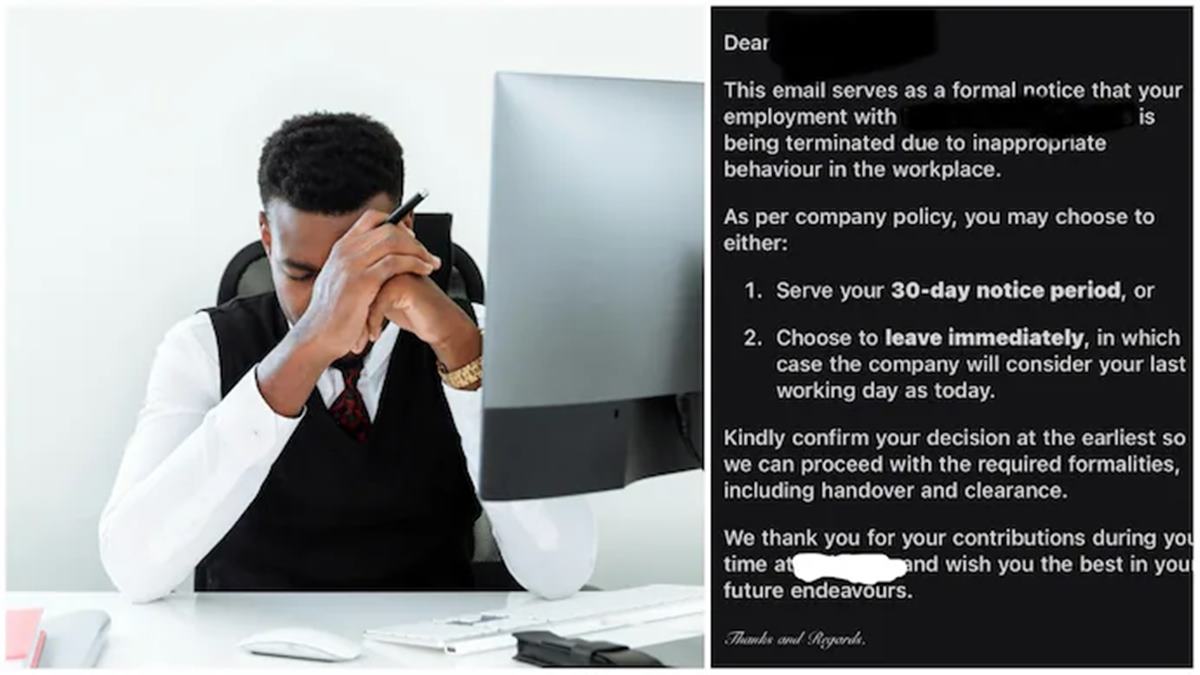

This is why employee engagement must be seen not as a siloed HR metric, but as a business imperative. Especially in the insurance industry, where trust is earned over time and reinforced through consistency, engaged employees are the foundation

Even as automation becomes more prevalent, the human element remains irreplaceable. A well-engaged workforce doesn’t just drive performance – it protects the brand, personifies its promise, and most importantly, makes it trustworthy.

It’s time for insurers to invest in their people as intentionally as they invest in their products. Because in a trust-driven industry, your most powerful differentiator isn’t just what you offer—it’s who delivers it.