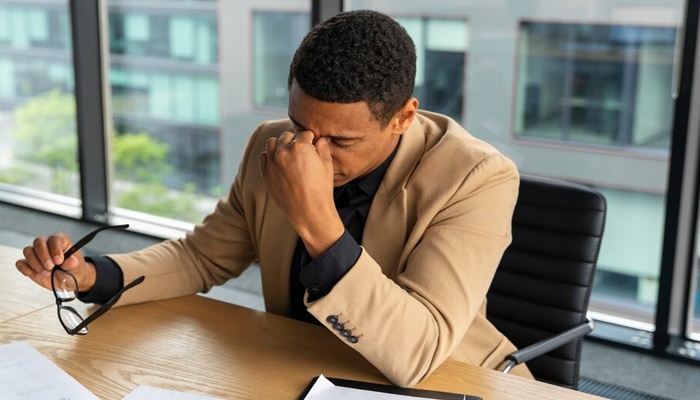

The idea that a higher income automatically brings comfort, ease, and freedom is something many young professionals believe—until reality sets in. For one 26-year-old, what seemed like a dream job offer with a salary jump from ₹40,000 to ₹1.3 lakh per month has done little to change his financial stress. Instead of experiencing the freedom that often comes with a bigger paycheck, he finds himself weighed down by family obligations, medical debt, and long-term financial responsibilities.

Sharing his story anonymously on Reddit, the user opened up about his struggle to stay afloat despite tripling his income. After relocating for a better job opportunity, his monthly expenses quickly began to eat into his salary. His current situation includes ₹20,000 in rent for a PG accommodation near his office, ₹20,000 as EMI for a personal loan taken during a medical emergency, ₹15,000 towards his parents’ EMI, and ₹10,000 sent home every month. Add to that his basic living expenses for food, transport, and other miscellaneous costs, and he’s left with very little each month.

He clarified that he doesn’t live extravagantly. “What’s frustrating is that I am not even splurging. No luxuries, no lifestyle upgrades. I walk a lot to cut transport costs, live frugally, and save where I can,” he wrote. The only major cost he admits could be adjusted is the rent, which he plans to reduce soon by finding more affordable housing.

Despite the higher income, his financial position remains tight, largely due to the debt his family incurred over the years. His father’s health condition prevented them from obtaining private medical insurance, leading to reliance on loans and corporate insurance cover. Most of his previous salary was absorbed by hospital bills and EMIs—responsibilities he continues to shoulder.

“Even with my dream monthly salary, debt and commitments make me feel suffocated. I dreamt of traveling, enjoying life, and financial freedom but the next 2–3 years look like just loan repayments,” he added. The emotional toll of constantly comparing himself to peers—many of whom appear to be saving aggressively or building wealth—has only added to the mental burden. “Sometimes I wish I had no debt, no responsibilities, just the chance to enjoy life as it comes.”

Still, he isn’t giving up. The post reveals his efforts to take control of the situation and plan for the future. He hopes to increase his SIP contributions from ₹2,000 to ₹15,000 per month, purchase separate medical insurance for his parents, begin part-prepayments on his loan to become debt-free faster, and save for a wedding he plans in the next couple of years. However, he’s unsure whether he should prioritise debt repayment or investing, and he’s seeking advice on how to strike the right balance.

He ended his post with several practical questions that many young earners in India may relate to: Should he focus on clearing loans before increasing SIPs? How can he get health insurance for his parents, given their medical history? What’s the best way to save for a wedding in two years? And what common financial mistakes should he avoid?

His story isn’t an isolated one. It highlights a familiar but often unspoken reality for many middle-class professionals: rising income doesn’t always mean rising freedom. For those supporting families, repaying old debts, or planning for major life events, the pressure of financial responsibility can follow them at every stage—even when the salary slips start to look impressive on paper.