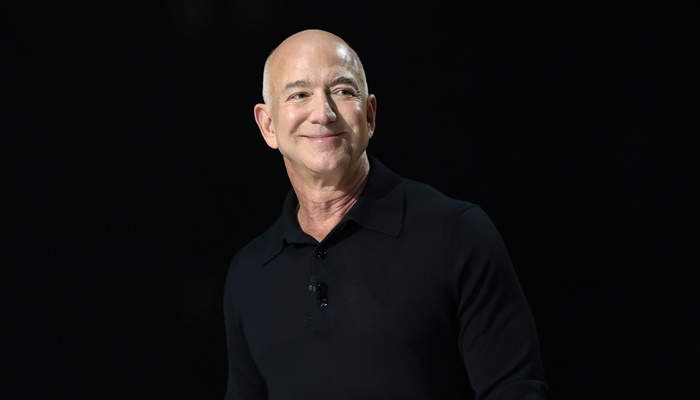

It might seem hard to believe that Jeff Bezos, a man now worth over $246 billion, lived on a salary that wouldn’t even qualify him as wealthy in some U.S. cities. For decades, the Amazon founder and former CEO paid himself just over $80,000 a year—a figure that remained stubbornly unchanged, even as Amazon transformed from a garage startup to a global tech empire. But behind that modest paycheck was a razor-sharp strategy that helped him quietly become one of the richest men alive.

‘I Just Didn’t Feel Good About Taking More’

Bezos’ decision wasn’t about humility alone—it was about ownership. Speaking to The New York Times, he explained, “I already owned a significant amount of the company and I just didn’t feel good about taking more.” For Bezos, being a founder meant aligning his wealth with Amazon’s growth, not annual bonuses or executive perks.

And it worked—brilliantly. According to Inc.com’s Jeff Haden, between 2023 and 2024 alone, Bezos earned the equivalent of $8 million per hour, simply by holding Amazon stock. “I had plenty of incentive,” he said. “I owned more than 10% of the company… how could I possibly need more?”

The Power of Equity Over Salary

Bezos’ philosophy wasn’t just about optics—it was structural. He called entrepreneurs like himself “owner-operators,” who focus not on increasing how much equity they hold, but on making their existing equity more valuable. “They don’t want more equity; they want to build something that makes their equity worth more,” he emphasized.

By opting out of salary raises and bonuses, Bezos maintained control and avoided diluting shareholder value—all while watching his personal net worth skyrocket.

The Tax Game No One Talks About

Of course, this strategy had another, quieter benefit: taxes. A 2021 ProPublica investigation revealed that Bezos paid no federal income tax in 2007 and 2011—partly because his modest salary allowed him to report investment losses that offset income.

Between 2014 and 2018, his “true tax rate” was just 0.98%. Warren Buffett paid even less—0.10%. These numbers, shocking as they are, underscore how U.S. tax policy favors those who build wealth through assets rather than income. Stock gains, unlike salaries, aren’t taxed until sold—giving billionaires like Bezos a massive tax advantage.

Strategic Sacrifice or Billionaire Blueprint?

Bezos once told Amazon’s compensation committee not to give him any perks or bonuses, saying he would have “felt icky” otherwise. “I’m very proud of that decision,” he added. But it wasn’t exactly a sacrifice. It was a move designed to optimize long-term wealth while minimizing exposure to taxes and scrutiny.

Only recently has Bezos begun selling some of his Amazon shares—an estimated 25 million by the end of 2025. These sales will trigger tax obligations, but they also convert paper wealth into spendable capital, possibly funding his space ambitions or philanthropic efforts.

The Founder’s Formula for Fortune

Bezos’ story isn’t just about restraint; it’s about redefining the path to immense wealth. His approach turned an $80K salary into a $246 billion fortune—not by chasing yearly bonuses, but by playing the long game with surgical precision.

In the end, Bezos didn’t need a big paycheck. He needed Amazon to thrive. And as the company soared, so did he—quietly, strategically, and spectacularly.