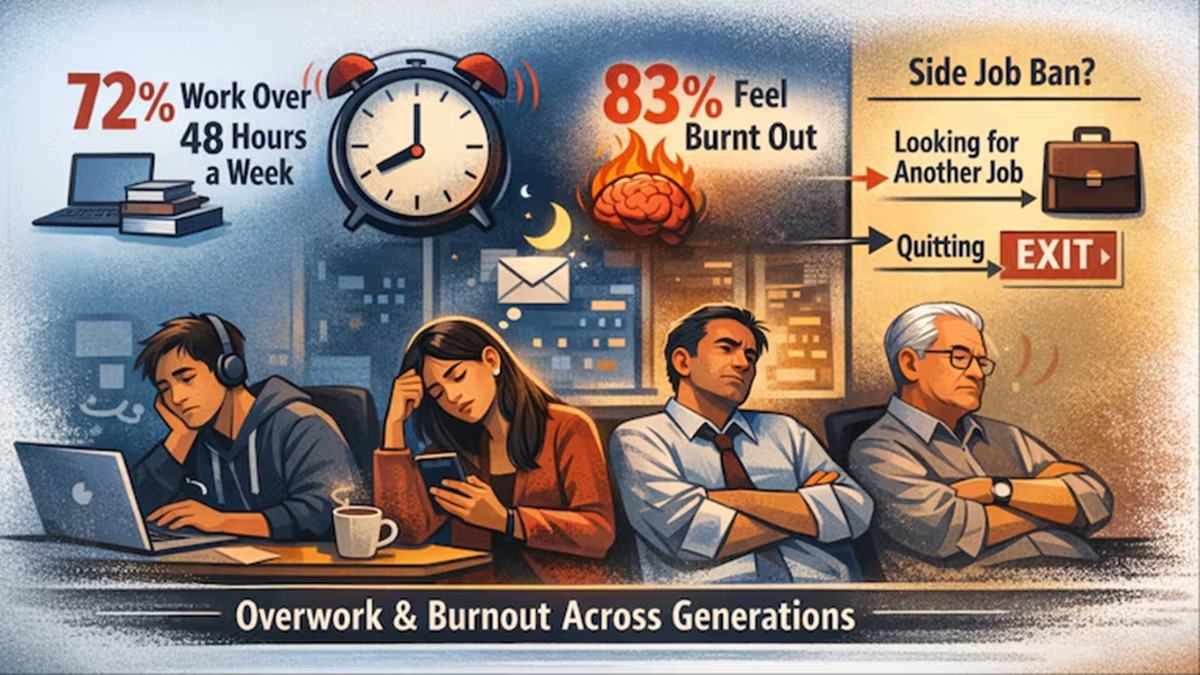

Mangesh Kothari*, 45, got a shock in April 2025 when he received an email from the human resource department, stating he was being laid off.

He had worked for the tech firm for 12 years, dedicating himself to his job, only to be asked to leave without warning. As he struggled to come to terms with his situation, he couldn’t help but think about the responsibilities on his shoulders.

“This is a challenging phase,” Kothari said. “I have to manage college expenses for my children, provide financial support for my ageing parents, and manage our home loan EMIs. With limited savings, it’s going to be tough to make ends meet. I’m not sure how I’ll be able to provide for my family like I used to,” he said.

In 2025, the tech industry is seeing another significant wave of layoffs, with giants like Microsoft, Google, Amazon, and CrowdStrike cutting thousands of jobs, as part of major restructuring efforts. Factors contributing to this trend include slowing revenue growth, ongoing macroeconomic uncertainties, and the increasing influence of artificial intelligence on traditional workflows. According to Layoffs.fyi, more than 130 companies have already let go of over 61,000 tech workers this year.

During times of job loss and economic uncertainty, effective financial planning can help you navigate money matters smoothly.

Emergency corpus: Your financial lifeline in uncertain times

Building an emergency fund is a crucial aspect of financial planning. According to Amol Joshi, founder of Plan Rupee Investment Services, it’s recommended to save money equivalent to 6-12 months’ household expenses and EMIs in a readily accessible fund, such as a savings account, short-term fixed deposit, or liquid fund.

“Use emergency funds strictly for essential expenses like food, medical bills, and insurance premiums – the bare minimum needed to get by,” advises Harshil Morjaria, a certified financial planner at ValueCurve Financial Services.

If you don’t have an emergency fund, reassess your portfolio. You might find traditional insurance policies or underperforming mutual funds that can be optimised. Additionally, you may have multiple liquid fund investments with small balances, which, when combined, could form a decent contingency fund.

Even physical gold and silver you don’t really need can be sold to build an emergency corpus.

This corpus can serve as a financial safety net, allowing you to cover essential expenses while you find a new job.

Effective spending and budgeting tips

During a job loss phase, it’s crucial to plug financial leaks by cutting back on unnecessary expenses. This means being mindful of your spending habits and prioritising essential expenses over discretionary ones.

For instance, consider skipping dining out, cancelling subscription services like streaming platforms or gym memberships, and delaying non-essential purchases like buying a new phone or taking a vacation. By doing so, you can conserve your resources and make your emergency fund last longer.

According to Joshi, budgeting allows you to gain financial control and make informed decisions about allocating your resources. This is particularly important during a job loss phase, when prioritising essential expenses like credit card dues, school fees, utility bills, and EMI payments become crucial.

Vishal Dhawan, Founder and CEO of Plan Ahead Wealth Advisors, advises having an open conversation with your family about job loss and the need to adjust expenses according to a revised budget. By doing so, all family members can contribute to monthly expenses, helping to mitigate the financial impact.

Allocate funds for upskilling after a job loss. Investing in a new course or training can help you shift to a new role or industry, potentially boosting your job prospects.

Tips for managing debt

Don’t stop paying your credit card bills and loan EMIs under any circumstances.

Credit cards and personal loans come with hefty interest rates – up to 48 percent per annum for credit cards and around 16 percent for personal loans. So, prioritise paying these off first.

According to Joshi, you should pay your credit card bill before the due date to avoid penalties and interest charges that can further strain your finances.

To avoid credit card bills, cut back on spending. Morjaria advises refraining from using credit cards until you secure another job.

If you’re paying EMIs, don’t halt them right away due to job loss. “Use your emergency fund to continue EMI payments for 3-6 months.” If you’re still struggling to find a job, consider alternatives like requesting a loan moratorium from your bank or extending your loan tenure, he adds.

Keep in mind that opting for a loan moratorium or extending the loan tenure can significantly increase your interest costs over time. It’s essential to make an informed decision, ideally after consulting a financial advisor. Once employed again, make loan pre-payments to reduce your debt.

Review your financial goals

A short-term job loss shouldn’t derail long-term financial goals, like children’s education or retirement savings. However, if unemployment drags on for six months or more, it’s wise to reassess and adjust these goals, according to Dhawan.

Short-term goals need reassessment since expenses are imminent, requiring careful planning on how to fund them.

Consider freelancing or consulting jobs on a contract basis for 3-6 months to cover essential monthly expenses and short-term goals.

Suresh Sadagopan, MD and Principal Officer of Ladder7 Wealth Planners, advises stopping SIPs after a job loss since there’s no regular income to support them, making it an unnecessary drain on your emergency fund.

“Restart monthly SIPs once your cash flow is back on track with the new job,” adds Joshi.

Don’t drain your retirement kitty

Avoid tapping into your public provident fund (PPF), employee provident fund (EPF) or other retirement investments, as it can negatively impact your long-term retirement savings.

Dhawan advises against using retirement savings for short-term needs during job losses, as it can compromise long-term goals. However, exceptions include medical emergencies or paying off high-interest debts or preventing defaults that can harm credit scores.